Thank you for choosing SafePal Software!

SafePal proudly announces our latest integration with FinTax, allowing users to easily complete cryptocurrency tax calculations, reporting, and portfolio management in the SafePal Wallet. FinTax is a Web3 professional financial management and tax filing platform for crypto assets. This article provides a detailed tutorial on how to download the cryptos transact records using FinTax for tax filling in the SafePal wallet.

This article contains the following steps:

- Step 1 Prepare the FinTax

- Step 2 Connect SafePal wallet to FinTax

- Step 3 Download the transact report

- Step 4 Complete

Step1 Prepare the FinTax

Open your SafePal App, search and find the FinTax web3 tool in SafePal DApp store, click on it.

Complete the registration and signing up using your individual email.

Note:

- Access Fintax through the SafePal DApp store to get a 10% OFF discount exclusive to SafePal users. You can only get it by accessing there.

- The discount will be automatically deducted at checkout and 10% OFF will be displayed

- Valid until December 31, 2025

Step2 Connect SafePal wallet to FinTax

FinTax hasn't supported Phone App access to download transact for tax filling reports now, please enter the link ' https://app.fintax.tech/ ' in your PC browser to launch the FinTax App. Login in with your account and password which you just signed up.

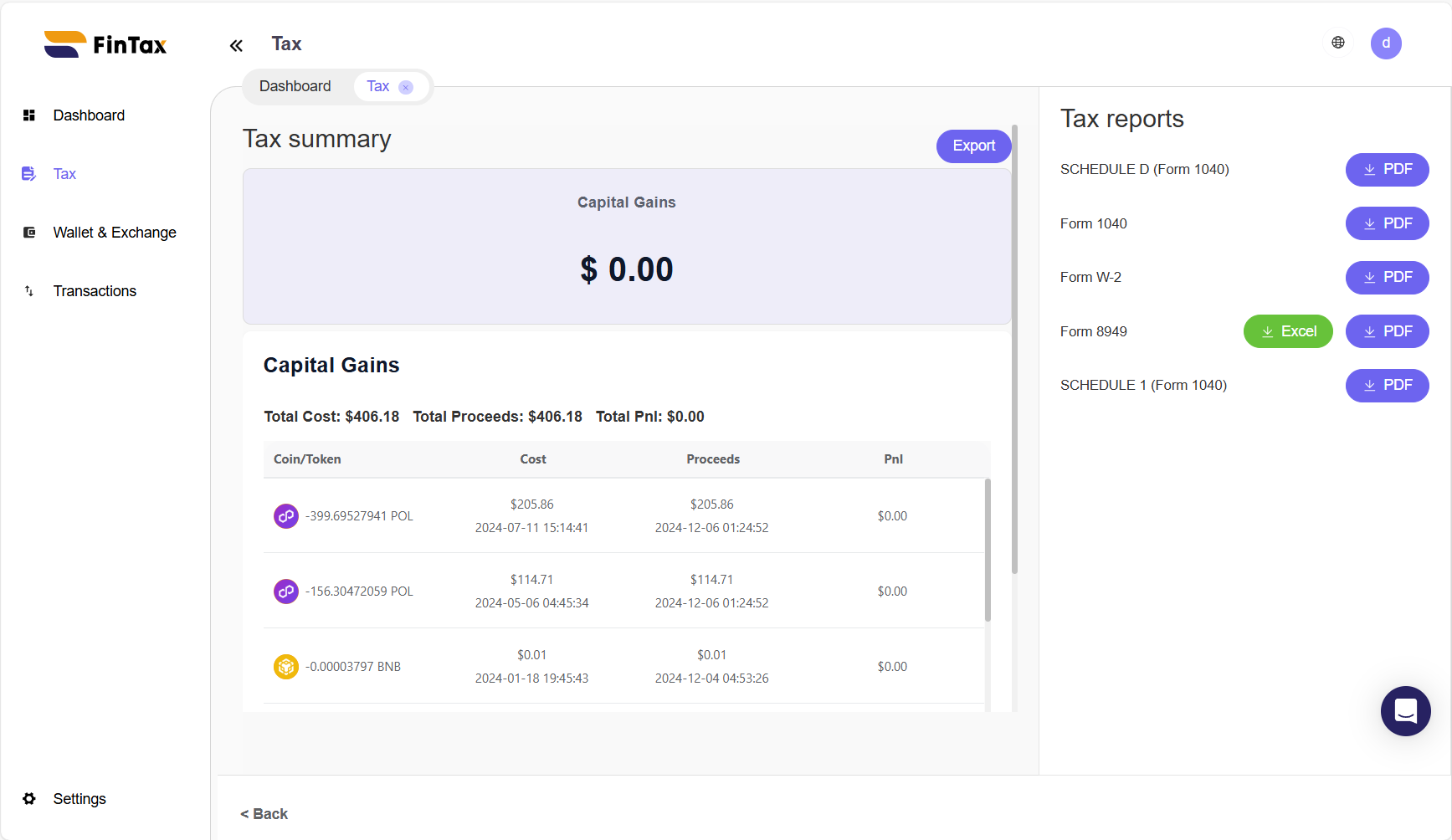

Click the Tax tab on the App homepage on the left side, choose your tax region and Cost Basis Method. This determines the applicable tax rules and regulations for processing your cryptocurrency transactions. You can click here to learn more about how to choose the Cost Basis Method of FinTax.

Click ‘Wallet/Exchange’, in the search bar you can search and find the SafePal wallet and click it.

Tap 'Connect SafePal'.

Click 'Connect' in your SafePal extension wallet.

Click 'Sign' and then enter the App password on your SafePal App to confirm the authorization to connect FinTax with your SafePal extension wallet.

Step3 Download the transact report

Select the networks of your wallet, click 'Import'.

Click the “View Transactions” button next to the account name to see all transaction details for that account, if you confirm then click 'Continue'.

After you tick all the answers to the questions for your tax filling then submit it, click 'Continue'.

Step4 Complete

Choose a payment method to pay for the tax filing report, you can pay in fiat or cryptos.

Continue to choose a cryptocurrency for the payment order.

Waiting for the payment to be confirmed.

Once the questionnaire is completed, FinTax delivers a detailed calculation of your taxable income, gains, and other relevant figures for the tax year. These results are immediately available for use in your tax forms.